I would like to kindly ask you to consider my rightful request for a customary pay adjustment so that my salary corresponds with the increase in the cost of living. Inflation for the Social Security COLA is calculated annually using.

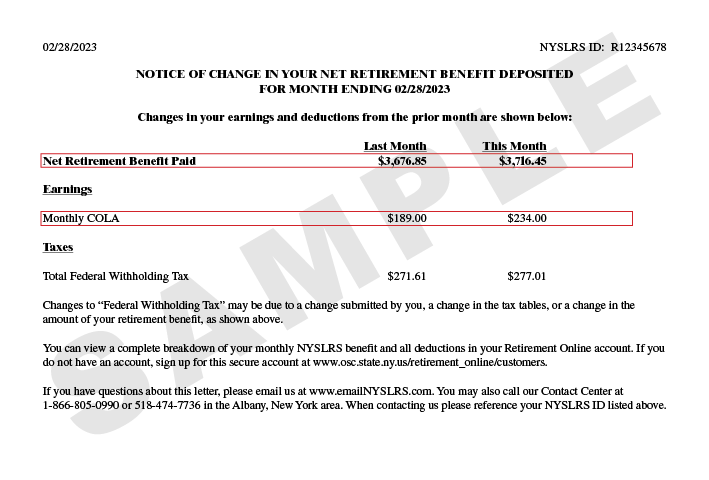

Cost Of Living Adjustment Office Of The New York State Comptroller

Cost Of Living Adjustment Office Of The New York State Comptroller

COLAs make complete sense for.

:max_bytes(150000):strip_icc()/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

Salary cost of living adjustment. Updated December 07 2020. A cost-of-living adjustment COLA is an increase in benefits or salaries to counteract inflation. The cost of living adjustment COLA is an increase in income that keeps up with the cost of living.

It is given in order to make up for inflation. 35000 x 0015 525 35000 525 35525. Some relocation packages include a cost-of-living stipend or cost-of-living adjustment to help cover increased expenses.

A cost of living raise may also be referred to as a cost of living adjustment COLA or cost of living increase. A cost-of-living pay adjustment refers to an increase in income based on an estimation of how much money is needed to maintain a standard of living. Inflation is measured using the consumer price index for urban wage earners and clerical.

A cost-of-living adjustment is a change in income or benefits that corresponds with the current cost of living. This type of pay adjustment can be applied to a variety of income that includes salaries benefits and more. A cost-of-living adjustment COLA is an increase in Social Security benefits to counteract inflation.

We offer you not only costs and income but also information on schools quality of life. Your company may offer a one-time lump-sum relocation bonus or pay an. Comparable salary in Chapel Hill NC.

For example the government may provide a COLA each year on Social Security benefits. Companies unions and governments make cost-of-living adjustments to offset inflation for employees. The most common instance of cost of living adjustments is the increase of Social Security benefits applied by the government each year.

A cost of living adjustment is an increase in pay that is meant to help you maintain a certain standard of living when facing inflation or moving to a new geographic location. These include union agreements executive contracts and retiree benefits. I want to live in.

2018 Cost-of-living adjustment for employees on salary levels 1 to 12 and occupation specific dispensations OSDs who are appointed in terms of the Public Service Act 1994 DPSA Circular 10 of 2018 signed 20 June 2018. What you are paid goes up based on the cost of the goods and services a typical person buys. I currently make 50K.

Cost of living adjustments should help you keep your purchasing power the same despite rising costs. These adjustments vary depending on the type of payment or benefits they affect. A cost-of-living adjustment COLA is an increase in salary or annuity usually based on an objective measure that estimates how much additional money a typical person or household needs to maintain their standard of living.

You give annual salary cost of living adjustments so you raise each employees wages by 15. If you live in one location but work in another the cost of living calculator will make those adjustments to provide an accurate estimate of the change in COL. Inflation acts against the buying power of every dollar.

This raise is most often applied in terms of benefits salaries and wages and may be implemented by companies and the government. See how far your salary will go to maintain your standard of living using our Cost of Living Calculator. I am confident that you agree with arguments presented above and I believe in your desire to do justice in.

Its often applied to wages salaries and benefits. If you live in one location but work in another the cost of living calculator will make those adjustments to provide an accurate estimate of the change in COL. Cost of Living Adjustments mean exactly that.

So if you have an employee who earns 35000 per year you would add 15 to their wages.