1341 mail fraud 1343 wire fraud 1344 bank fraud or 1348 securities fraud or any rule or regulation of the Securities and Exchange Commission or any provision of Federal law. This document sets out the text of the Sarbanes-Oxley Act of 2002 as originally enacted.

Sarbanes Oxley Compliance And Application Security Immuniweb

Sarbanes Oxley Compliance And Application Security Immuniweb

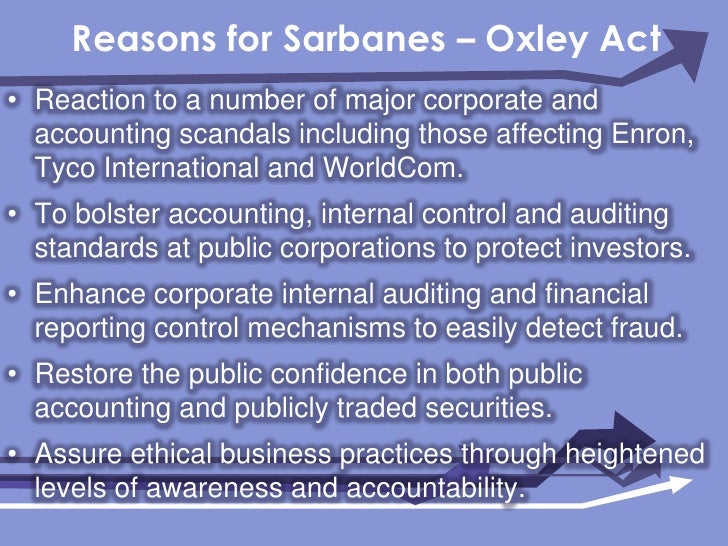

Revelations that corporate executives filed misleading financial statements and of cozy.

Sarbanes oxley law. Congress passed SOX in 2002 after a string of corporate scandals most prominently at Enron and WorldCom shocked the public and rattled markets. The Sarbanes-Oxley Act is a federal law that enacted a comprehensive reform of business financial practices. 1 IN GENERAL- It shall be unlawful for any issuer as defined in section 2 of the Sarbanes-Oxley Act of 2002 directly or indirectly including through any subsidiary to extend or maintain credit to arrange for the extension of credit or to renew an extension of credit in the form of a personal loan to or for any director or executive officer or equivalent thereof of that issuer.

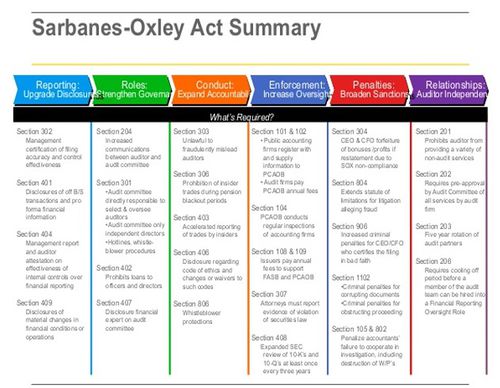

The Act now holds CEOs responsible for their companys financial statements. The Sarbanes-Oxley Act Sarbanes-Oxley is a federal law that established new and enhanced standards for public company boards as well as management and public accounting firms. Public Company Accounting Oversight Board - Establishes the Public Company Accounting Oversight Board Board to.

In 2002 Congress passed the historic Sarbanes-Oxley Act which protects employees of publicly traded companies who report violations of Securities and Exchange Commission regulations or any provision of federal law relating to fraud against the shareholders. The Sarbanes-Oxley Act is arranged into eleven titles. Sarbanes-Oxley was enacted after several major accounting scandals in the early 2000s perpetrated by.

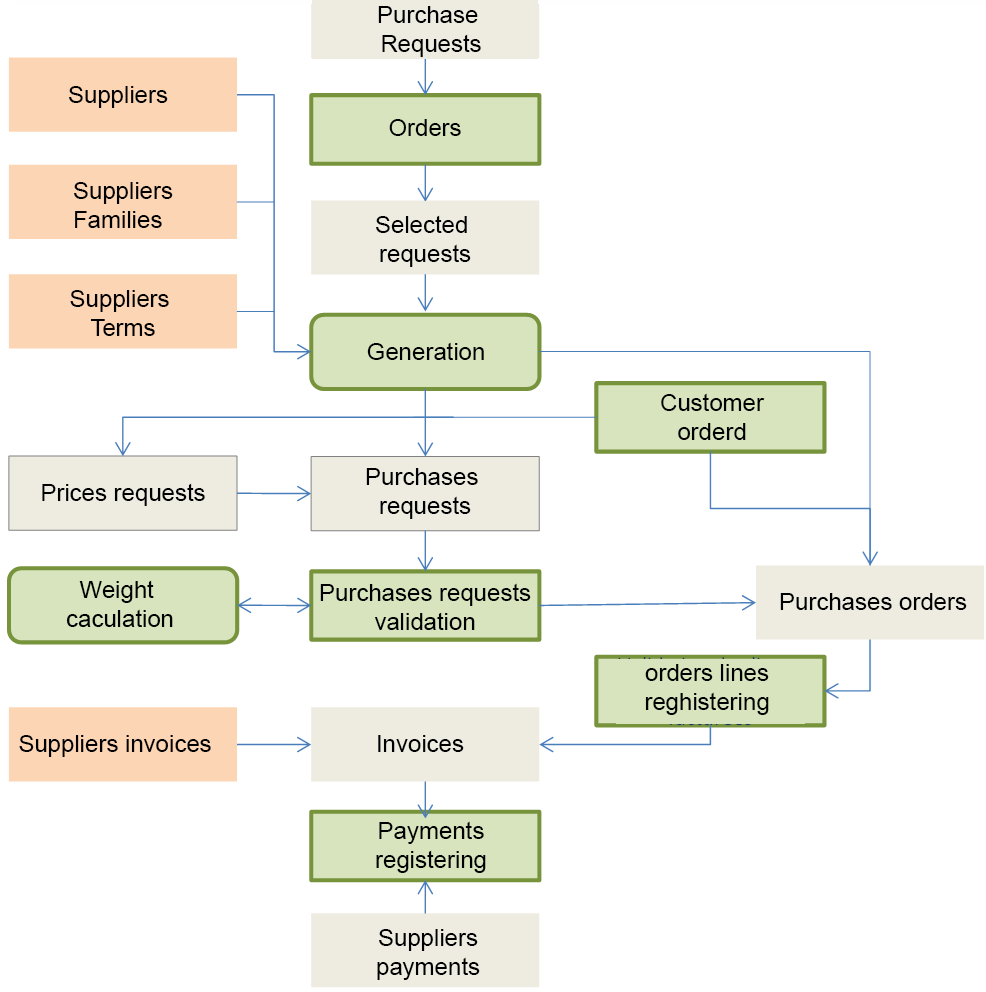

Congress passed on July 30 of that year to help protect investors from fraudulent financial reporting by corporations. And 3 inspect investigate and enforce compliance on the part of registered public accounting firms their associated. As far as compliance is concerned the most important sections within these are often considered to be 302 401 404 409 802 and 906.

The Sarbanes-Oxley Act commonly called SOX reformed corporate financial reporting and the accounting profession. The Sarbanes-Oxley Act sometimes referred to as SOA Sarbox or SOX is a US. The Sarbanes-Oxley Act of 2002 often simply called SOX or Sarbox is US.

Section 806 of the Sarbanes-Oxley Act prohibits certain covered employers from retaliating gainst employees who provide information to a covered employer or a federal agency or Congress regarding conduct that the employee reasonably believes constitutes a violation of 18 USC. An over-arching public company accounting board was also established by the act which was introduced amidst a host of publicity. The maximum sentence term for.

2 establish audit report standards and rules. Under Sarbanes-Oxley public companies must adopt a business ethics code and create an internal procedure by which employee reports about fraud or. The Sarbanes-Oxley Act was passed by Congress to curb widespread fraudulence in corporate financial reports scandals that rocked the early 2000s.

Law passed in 2002 that aimed to protect investors by preventing fraudulent accounting and. Sarbanes-Oxley Act of 2002 On July 30 2002 President Bush signed into law the Sarbanes-Oxley Act of 2002 which he characterized as the most far reaching reforms of American business practices since the time of Franklin Delano Roosevelt. The 2002 Sarbanes-Oxley Act aims at publicly held corporations their internal financial controls and their financial reporting audit procedures as performed by external auditing firms.

Sarbanes-Oxley Act of 2002 - Title I. 1 oversee the audit of public companies that are subject to the securities laws. Law meant to protect investors from fraudulent accounting activities by corporations.

Amendments to the Act made by the Dodd-Frank Wall Street Reform and Consumer Protection Act July 21 2010 can be. The Sarbanes-Oxley Act imposes harsher punishment for obstructing justice securities fraud mail fraud and wire fraud. The Sarbanes-Oxley Act of 2002 is a law the US.