In this post I describe how your organization can define its risk toleranceUnsupported operating systems can expose your network to attack. It indicates how sensitive organizations stakeholders and people are towards risks.

Risk Appetite Vs Risk Tolerance Definitions Differences

Risk Appetite Vs Risk Tolerance Definitions Differences

Qualitative risk tolerances are useful to describe the companys preference for or aversion to particular types of risk particularly.

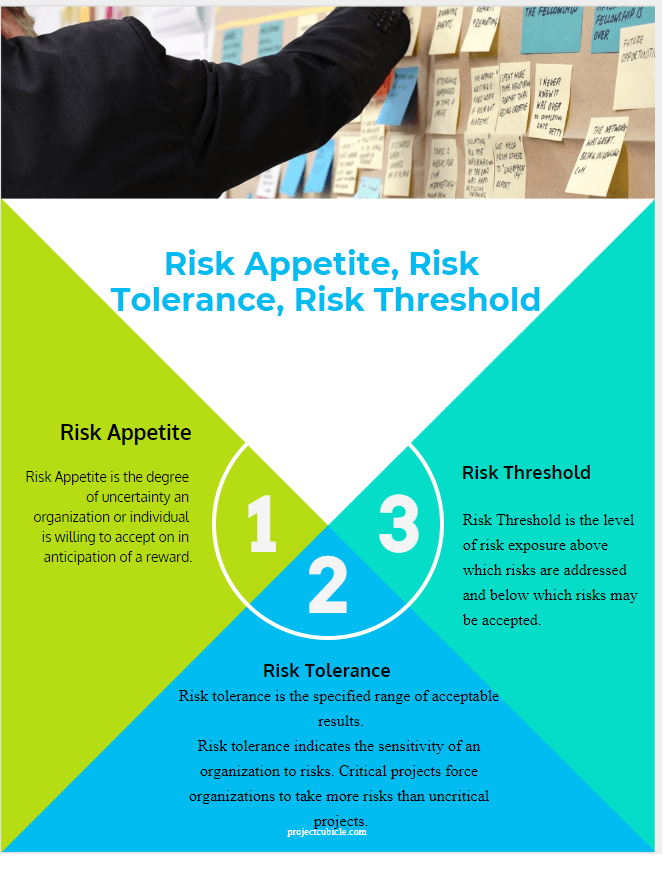

Risk tolerance definition. Risk tolerance is a measure of the level of risk an organization is willing to accept expressed in either qualitative or quantitative terms and used as a key criterion when making risk-based decisions. Risk tolerance is the extent to which you as an investor are comfortable with the risk of losing money on an investment. Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand in their financial planning.

Organisations have to take some risks and avoid others. On the other hand if youre willing to take some risk by making investments that fluctuate. To do so they need to be clear about what successful performance looks like.

It indicates how sensitive organizations stakeholders and people are towards risks. The department of transportation or other government entity sets a speed limit. Risk tolerance is the degree volume or amount of risk that an organization can withstand.

Risk tolerance measures the levels of risk taking acceptable to achieve a specific objective or manage a category of risk. If youre unwilling to take the chance that an investment that might drop in price you have little or no risk tolerance. Risk tolerance--the amount of risk an organization is willing to accept--should be part of your organizations comprehensive risk management program.

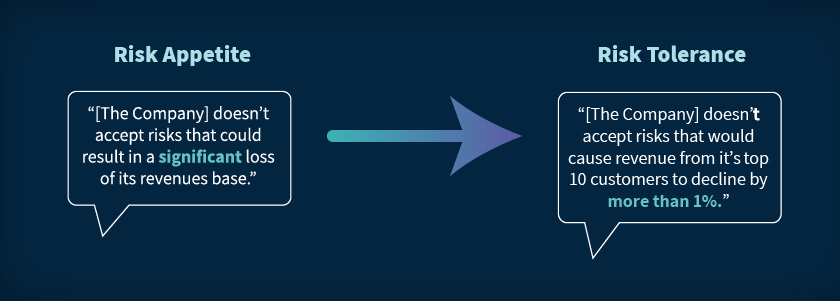

Risk appetite and performance. Risk tolerance is a quantitative measure to support the risk appetite. The term risk tolerance is defined and used in different ways.

Tolerance thresholds are set to inform risk mangers when a risk profile is moving towards the edge of a risk appetite. Risk tolerance is the degree of risk or uncertainty that is acceptable to an organization. The degree of variance from the organizations risk appetite that the organization is willing to tolerate Given these definitions a simple analogy for appetite and tolerance would be speed on a highway.

While risk appetite is about the pursuit of risk risk tolerance is about what an organisation can actually cope with. Whether risk tolerance is a stable characteristic of a given investor or also takes into account external circum-stances eg economic shocks or the domain of the decision depends on how it is defined and measured. This blog series outlines five actions your organization can take now including defining risk tolerance.

The companys qualitative and quantitative boundaries around risk taking consistent with its risk appetite. Risk tolerance is an important component in investing. For Swanepoel risk tolerance is the level of risk that an organization can accept per individual risk whereas risk appetite is the total risk that the organization can bear in a given risk profile usually expressed in aggregate.

This brief focuses on a definition of risk tolerance prevalent in.