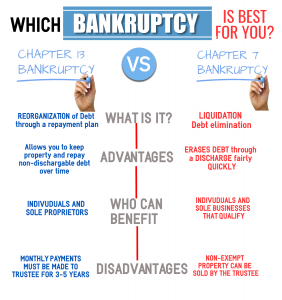

For example in most cases past due taxes arrears related to child or spousal support and student loans must be repaid. Chapter 7 bankruptcy remains on your report for up to 10 years and Chapter 13 stays there for up to seven years.

Which Chapter Is Right For Me Chapter Bankruptcy Lawyers

Which Chapter Is Right For Me Chapter Bankruptcy Lawyers

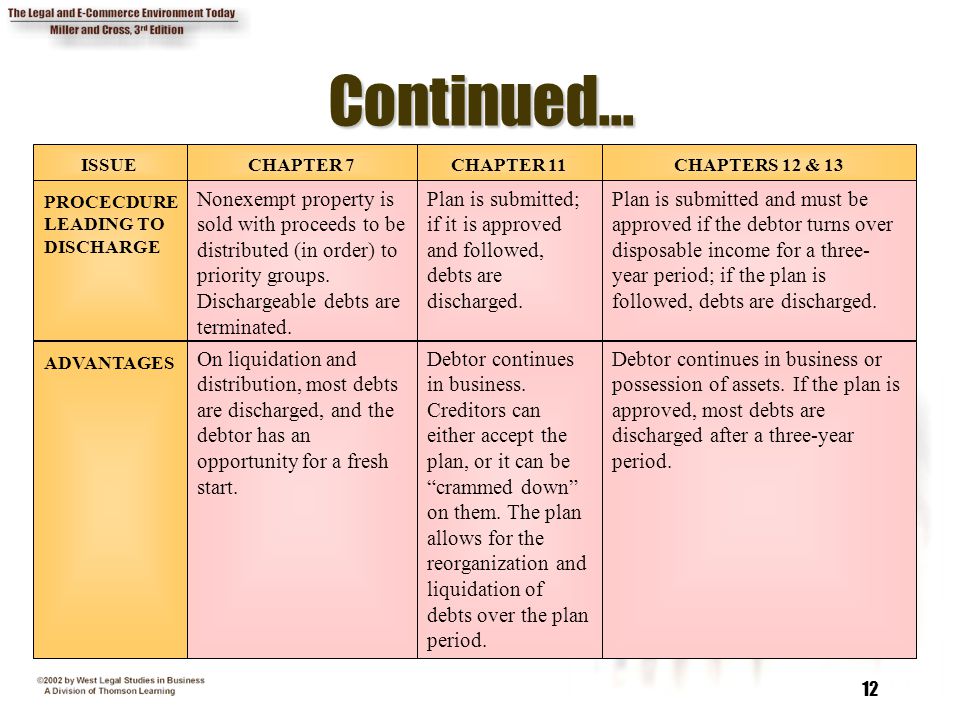

Property Chapter 7 resolutions involve selling all nonexempt property.

Difference between chapter 7 and chapter 13. Chapter 13 will make more sense if youre behind on your mortgage and want to keep your house. However there are several criteria to qualify for a Chapter 7 filing. This is because Chapter 13 works by reorganizing your debt as opposed to totally wiping it clean.

There are debt limits in place for Chapter 13 but most individuals seeking bankruptcy protection fall under the limits. Similar to the Chapter 7 redemption the cramdown allows you to reduce your loan down to the market value of the property. It is easy to see that both chapter 7 and chapter 13 are intended to help a person facing a financial crisis.

However a Chapter 7 bankruptcy filing can wipe out all consumer debt. Our firm offers. To learn more about the differences between Chapter 7 and Chapter 13 bankruptcy contact our office.

Thats the difference between Chapter 7 and Chapter 13 in a nutshell. The main differences between Chapter 7 and Chapter 13 bankruptcy is that most individuals use Chapter 7 for bankruptcy it is faster and less expensive. Unlike Chapter 7 that liquidates almost everything you own a Chapter 13 will only reorganize your debts and give you more time to settle them usually between three to five years.

Chapter 13 bankruptcies involve payment plans that typically span 3-5 years. Its not an ideal credit situation of course but you can use the time to manage your debts wisely and make consistent on-time payments. It however takes a much different approach than Chapter 7.

This is most often used for upside down loans on cars and mortgages for investment properties. Chapter 7 bankruptcy relates to the liquidation or selling of personal properties for the settlement of outstanding debts. The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging getting rid of unsecured debt such as credit cards personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or.

Chapter 13 offers an immediate and near-guaranteed debt relief while Chapter 13 provides a more favorable repayment option to avoid foreclosure. In addition to this there is a limit to the unsecured debt someone can have when filing a Chapter 13. Chapter 13 is available to individuals and self-employed individuals sole proprietors but not to businesses.

Here are the basic principles behind Chapter 13 bankruptcy. There is an option for reducing balances owed on secured debts which is called a Chapter 13 cramdown. There are many other subtleties and only the best Athens bankruptcy lawyers know how to take full advantage of these subtleties.

Both Chapter 7 and Chapter 13 present debtors with very appealing options to recover from their current financial crisis. The information required to be furnished to the courts is same as chapter 7. Learn when Chapter 7 bankruptcy is a better choice than Chapter 13.

However there are also limitations to. The main difference is that the flag for a Chapter 13 bankruptcy is removed from the debtors. Chapter 7 bankruptcy can be considered straight bankruptcy while chapter 13 is considered re-organisation bankruptcy.

The main difference between Chapter 7 and Chapter 13 is that a Chapter 7 will allow the debtor to eliminate all dischargeable unsecured debt whereas the Chapter 13 would allow for payments to be made on those debts. Call 847-549-0000 for a free phone consultation at Newland Newland LLP today. Chapter 7 is a popular choice because unlike Chapter 13 it doesnt require filers to pay back a portion of their debts.

Our knowledge helps our clients put their bankruptcy filings behind them. Compare chapter 7 and 13 The debtor keeps the exempt assets Download List Of Arizona Exemptions 7575 downloads while the bankruptcy trustee liquidates the non-exempt assets and distributes the proceeds to the existing unsecured creditors. Unlike Chapter 7 where your assets are sold in order to fund debt repayments people who file for Chapter 13 bankruptcy get to keep their assets.

Unlike Chapter 13 the discharging of debts under Chapter 7 is not necessarily contingent upon repayment of those debts. A court fee of 194 is applicable while filing for bankruptcy under chapter 13. Bankruptcys protected repayment period lasts up to five years.

The court will total all your secured and unsecured debts and then set a more affordable repayment plan that is. Under Chapter 7 the proceeds of the liquidation of the debtors non-exempt property is distributed to creditors based upon the priority of the creditors claim. However declaring bankruptcy is not without consequences.

Call 847-549-0000 for Help. The primary difference between Chapter 13 and Chapter 7 bankruptcy is what debts are eliminated. Initially Chapter 7 and Chapter 13 have the same effect on a credit score which diminishes over time.

Discharge duration Chapter 7 bankruptcies usually resolve within 3-4 months.