This corresponds to the data dictionary entry for BMF 082016. Small to Mid-Size Tax Exempt Organization Workshop Suspensions Pursuant to Code Section 501 p.

Irs Masterfile Data For Mit Fsilgs

3135 Individual Master File IMF Account Numbers Manual Transmittal.

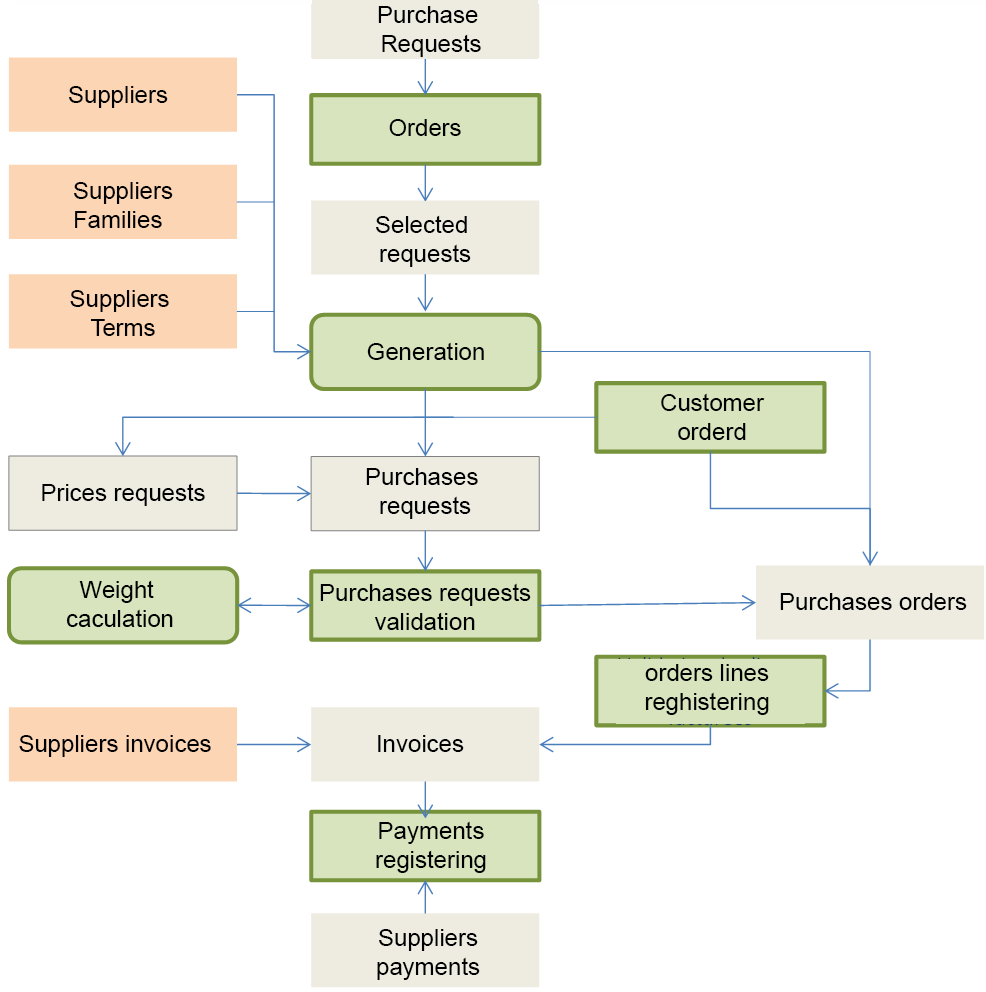

Irs master file. The information in the master file. The Master File MF Decoder software is a specialized Microsoft Access database intended to automate the decoding and analysis of your IRS electronic records. Bmfbm1608csv refers to the Business Master File for August 2016.

The Information Returns Master File IRM has details of information returns such as Form W-2s and Schedule K-1s issued to a taxpayer. IRS Business Master Files use the following naming convention. Finally the Individual Retirement Account File IRAF has tax and entity information for taxpayers.

Purpose 1 This transmits an interim procedural update Revised for IRM 3135 Campus Document Services - Individual Master File IMF Account Numbers in IRM 313 Campus Document Services in accordance with IRM 1112561 Preparing the Manual Transmittal. Master File and Local File. The Individual Master File IMF is a magnetic tape record of all individual income tax filers in Social Security Number sequence and is maintained at the IRS National Computer Center.

All tax data and related information pertaining to individual income tax payers are posted to the IMF so that the file reflects a continuously updated and current record of each Citizens account. 5 Debtor Master File Research. Information about a DMF offset can be obtained from various sources.

Master File Tax Code MFT The MFT reduces the numerous types of tax to a two digit code. The definitions of several transaction codes are necessarily changed since there will be no resequencing offsetting or. Further the MF may be prepared for the group as a whole or on a line of business basis provided all centralized functions and transactions are described thoroughly in the MF.

Anyone whos every earned wages or paid taxes has amassed an Individual Master File IMF. Rejection should have been accompanied by an IRS rejection code explaining why it was rejected. A copy of all documents maintained in the system of records identified as Individual Master File IMF specific and not literal.

It is accessed through and provides direct retrieval of master file data via IDRS realtime and DIS or Zilog input. These data represent the National Center for Charitable Statistics NCCS IRS Business Master File of all tax exempt organizations registered with the IRS at the date marked on the file. It is expected to assist in evaluating the presence of significant transfer pricing risk.

Microfilm Replacement System MRS The Microfilm Replacement System MRS is a realtime mode that supports a myriad of functions. IRS Master FIle - IRS Income Reports We Can Pull Your Records Directly From The IRS 0500 Primary SSN SEQ 0010 and Primary Name Control SEQ 0050 of the Tax Form must match data from the IRS Master File IRS Master File. The Exempt Organizations Business Master File Extract provides information about an organization from the Internal Revenue Services Business Master File.

The IRS issues an Error Reject Code ERC when the IRS rejects an electronic file. Use Command Codes CC IMFOL BMFOL INOLEX and TXMOD to identify the DMF transactions. Data Services Treasury24030 IMF MCC TRANSCRIPT- COMPLETE.

The following is a list of the agencysubagency codes that participated in the DMF. Effective 1111999 CC DMFOL is no longer available to research DMF offsets. What action can I take to resolve IRS Master File rejections.

The files are available in comma separated value CSV format. Business Master Files Download Site csv. Data Service TreasuryIRS 24030 IMF MCC TRANSCRIPT-SPECIFIC.

Individual Master File IMF. The Employee Plans Master File EPMF has information on returns filed for trusts and pensionprofit sharing plans established for employees by firms or organizations. The file is a resource for any curious taxpayer or anyone wanting to mount evidence against an IRS error or audit.

Verify that the taxpayers name or SSN is correct in the tax return. This is a cumulative file and the data are the most recent information the IRS has for these organizations. Open the appropriate tax return and click Client.

Transaction on the Master File to permit compilation of reports and to identify the transaction when a transcript is extracted from the Master File. This information is available by state and region for downloading. The Guidelines provide that the master file should be made available to all relevant tax authorities in the jurisdictions where the members of the group are resident.

Bmfbm2 digit year of release2 digit month of releasecsv. The Exempt Organizations Business Master File Extract has information about organizations that have received a determination of tax-exempt status from IRS. A master file should give a high-level overview of the group of enterprises including the global business operations and transfer pricing policies.

The IMF contains every transaction and financial record gathered by IRS officials throughout the course of your lifetime. Transaction codes that are unique to IDRS are also included. To correct the error code verify that the information entered in UltraTax CS agrees with supporting documents such as a Social Security card that your clients provide for their returns.

Primary SSN SEQ 0010 and primary Name Control SEQ 0050 of the Tax Form must match data from the IRS Master File CAUSE The name or SSN entered in the tax return does not match the name or SSN that the IRS has in their database.

/article-new/2017/03/airpodssoundplaying.jpg?lossy)