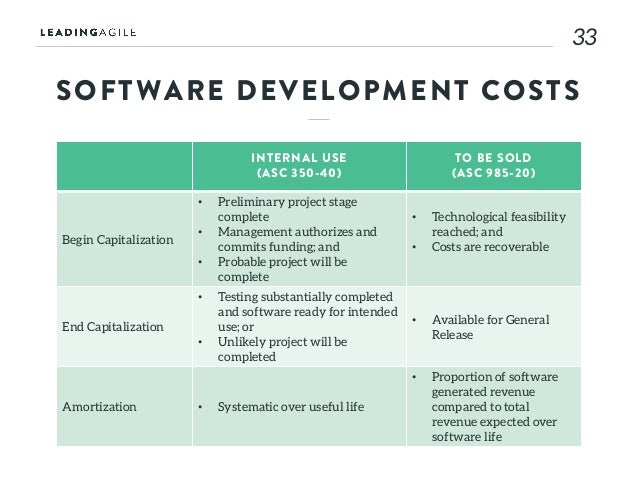

Despite GAAP guidelines calling for the capitalization of certain software development expenses our experience and the experience of our SaaS accounting partners at PlusPoint Consulting indicates approximately 75 of SaaS businesses are no longer capitalizing software development expenses at all. The capitalized cost of external-use software must be amortized through the cost of goods sold expense on a product-by-product basis.

Capitalize Software Development Costs Wall Street Prep

Capitalize Software Development Costs Wall Street Prep

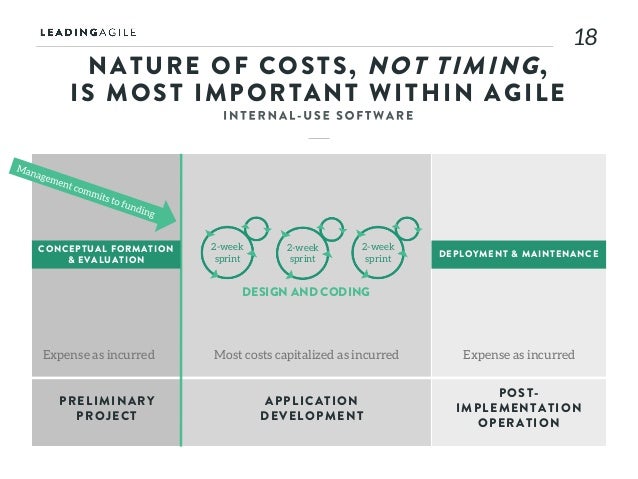

Once a project has reached the application development stage costs and time incurred both internal and external related to software configuration and interface design coding hardware installation and testing with parallel processing would then be capitalized as an asset until the time of implementation.

Capitalized software costs. After the software goes live the capitalized software development costs are amortized over the estimated useful life of the software. The Short Answer is Yes. Ad TallyPrime software bisnis yang memudahkan hidup dan bisnis Anda.

We wont dive into the complicated specifics in this article. Entities should capitalize the cost of software when such software meets the criteria for general property plant and equipment PPE. GAAP has rules for capitalization of software development costs.

Begin capitalizing costs once the preliminary tasks are completed management has committed to fund the project and you can reasonably expect that the software will be completed and used as intended. The costs you should capitalize are those that are directly related to the development deployment and testing of the software. -5Data conversion costs except as noted in paragraph 350-40-25-3 shall be.

Accountants accomplish this by recording software costs on the balance sheet as capital expenses. Proses instal yg mudahAnda dapat mulai memakai TallyPrimesejak hari pertama pembelian. In accounting software capitalization is the process of recognizing in-house software as fixed assets.

Capitalize the costs incurred to develop internal-use software which may include coding hardware installation and testing. This publication unravels the FASBs guidance on accounting for software costs in ASC 350-40. This is typically two to five years and is generally done using the straight-line amortization method.

Proses instal yg mudahAnda dapat mulai memakai TallyPrimesejak hari pertama pembelian. Some of a customers costs to implement such an arrangement may be capitalized under the guidance in ASC 350-40. GAAP states that certain costs for both internal-use and external-use software should be capitalized.

-3 Costs to develop or obtain software that allows for access to or conversion of old data by new systems shall also be capitalized. That advice is probably not going to apply to most software as a service arrangements because there is no application development. Capitalized software costs are costs such as programmer compensation software testing and other direct and indirect overhead costs that are capitalized on a companys balance sheet.

For a company that utilizes an off-the-shelf software package for their general ledger the cost of the software would be capitalized along with the costs of any future upgrades. Any costs related to application development are capitalized depending on what they are. Even if audited outside accountants faced with well-reasoned arguments from their clients are no longer requiring capitalization.

Any significant payroll costs incurred to implement this software could also be capitalized. Takes or can take possession of the software. And any costs incurred during the preliminary project and post-implementation stages are charged to expense.

The ultimate purpose of capitalizing is to delay fully realizing an expense. Any costs related to data conversion user training administration and overhead should be charged to expense. Stop capitalizing costs once all substantial testing is.

The amount to be amortized should be the greater of. -4 Training costs are not internal-use software development costs and if incurred during this stage shall be expensed as incurred. Ad TallyPrime software bisnis yang memudahkan hidup dan bisnis Anda.

The rules depend on whether the developed software will be used internally or sold externally. Then accountants can amortize these costs over time.

Accounting For Your Institution S Core Software Conversion Doeren Mayhew Cpas

Accounting For Your Institution S Core Software Conversion Doeren Mayhew Cpas

Capex And Opex Scaled Agile Framework

Capex And Opex Scaled Agile Framework

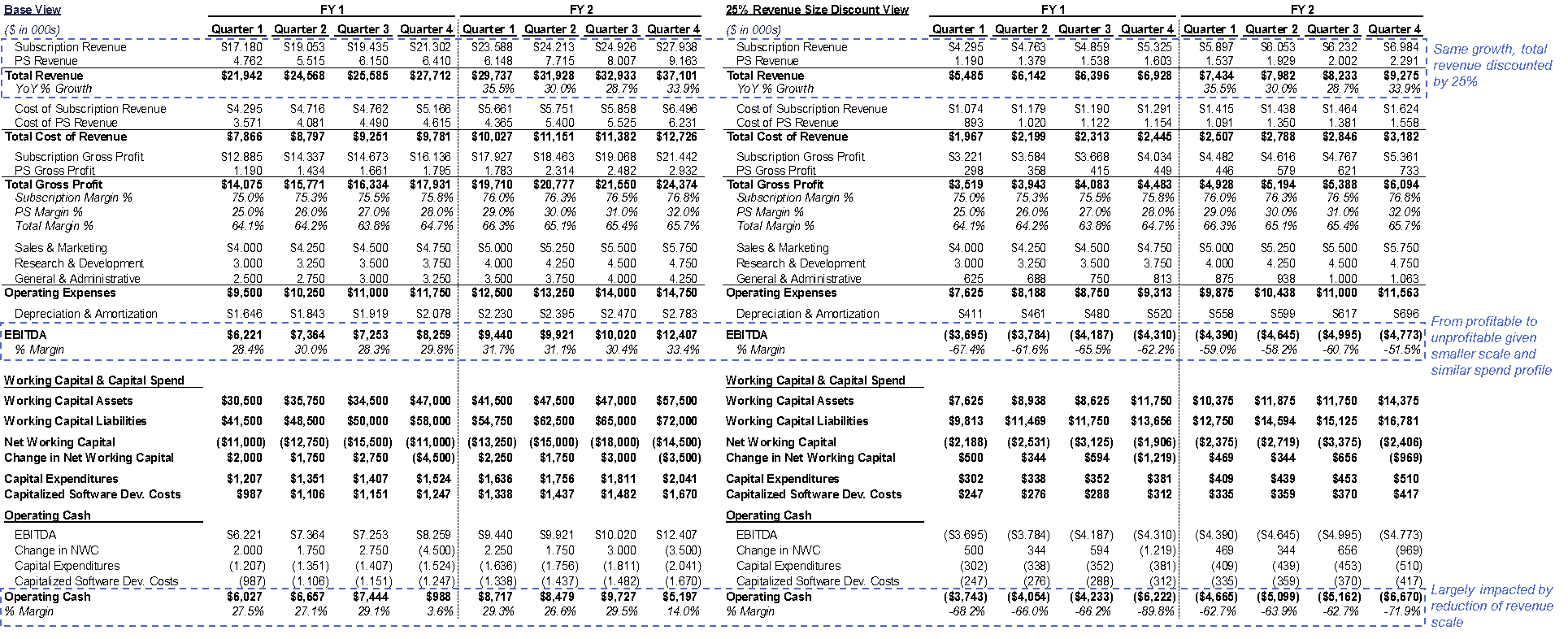

Primer On Operating Cash Flow Years Ago One Of My Earliest Memories By Ramin Zacharia Medium

Primer On Operating Cash Flow Years Ago One Of My Earliest Memories By Ramin Zacharia Medium

Capitalize Software Development Costs Wall Street Prep

Capitalize Software Development Costs Wall Street Prep

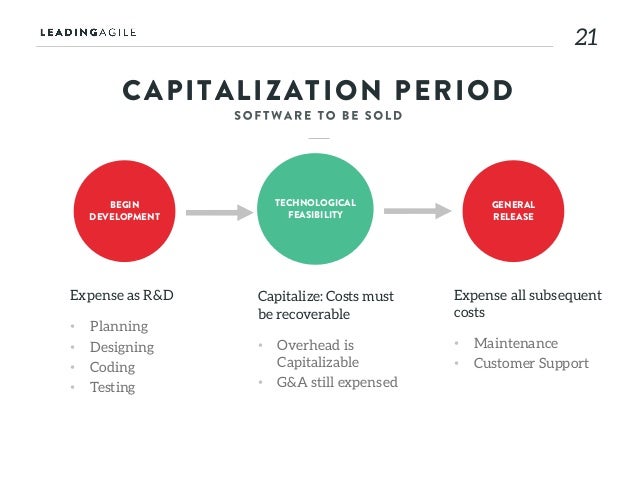

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

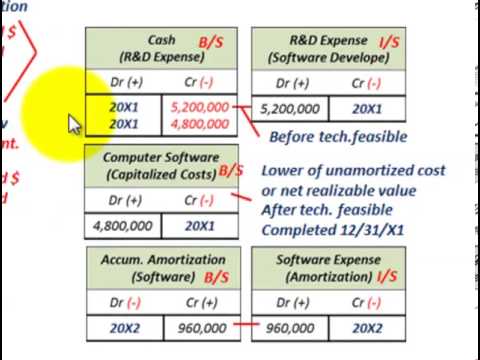

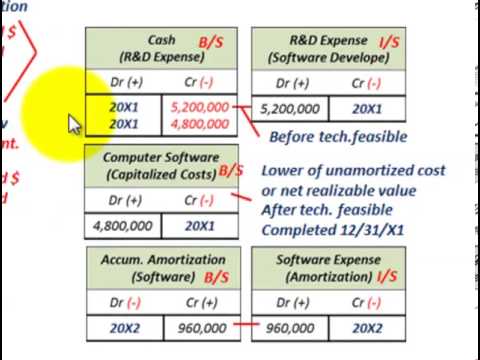

Intangible Assets Accounting Computer Software Capitalization Amortization R D Expense Youtube

Intangible Assets Accounting Computer Software Capitalization Amortization R D Expense Youtube

Saas Technical Accounting Series Issue 1 Capitalized Software Development Tanner

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Software Cost Capitalization And Scrum Strm Alm Blog

Software Cost Capitalization And Scrum Strm Alm Blog

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.