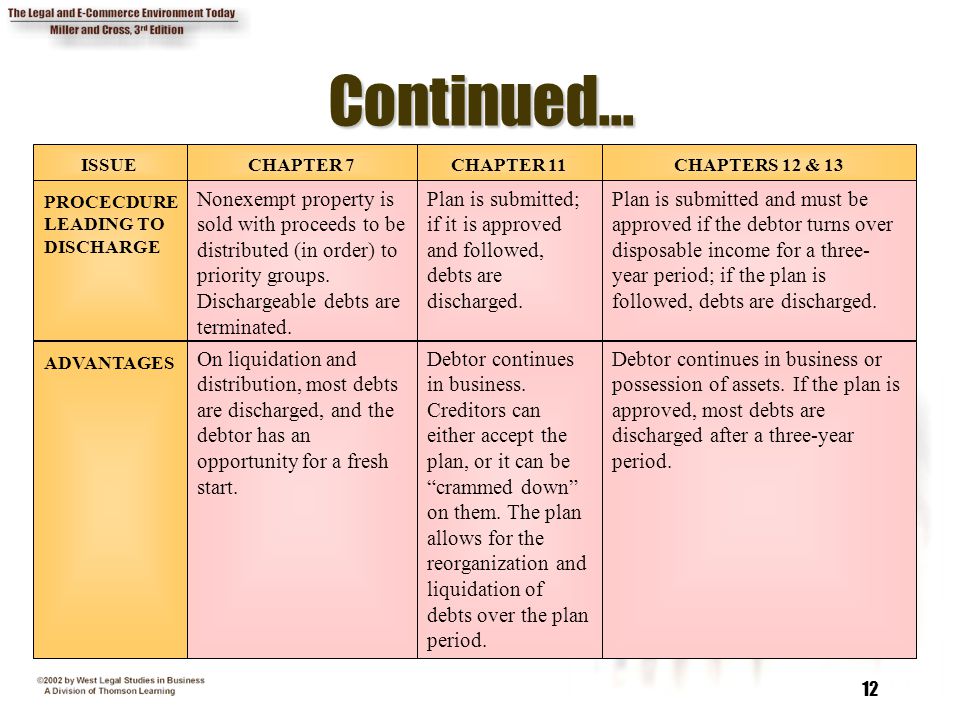

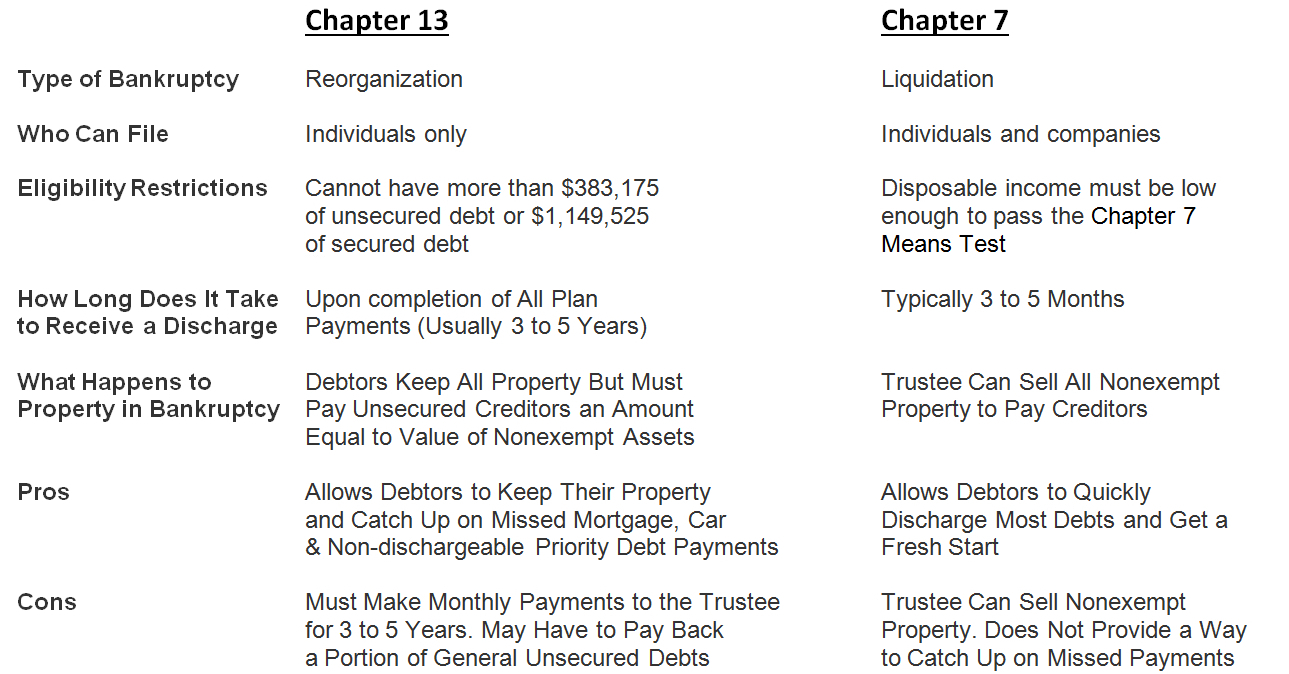

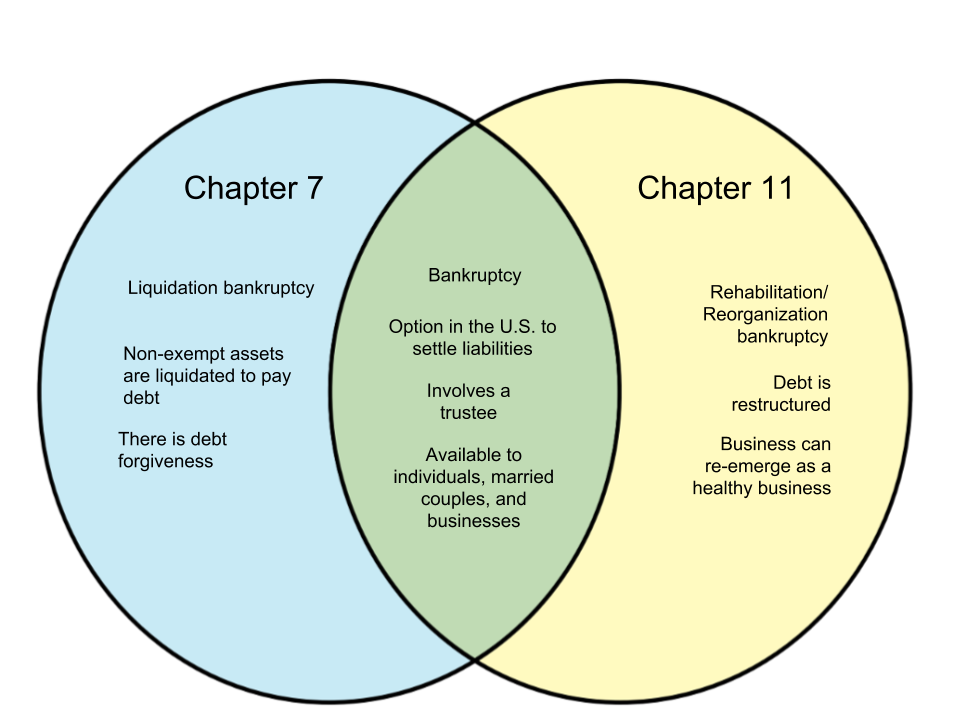

Instead debtors must repay delinquent debts over time. The biggest difference between Chapter 11 and Chapter 7 is that Chapter 11 is a reorganization bankruptcy while Chapter 7 is a liquidation bankruptcy.

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Any missed or late payments can result in the case being dismissed which puts the debtor back at square one.

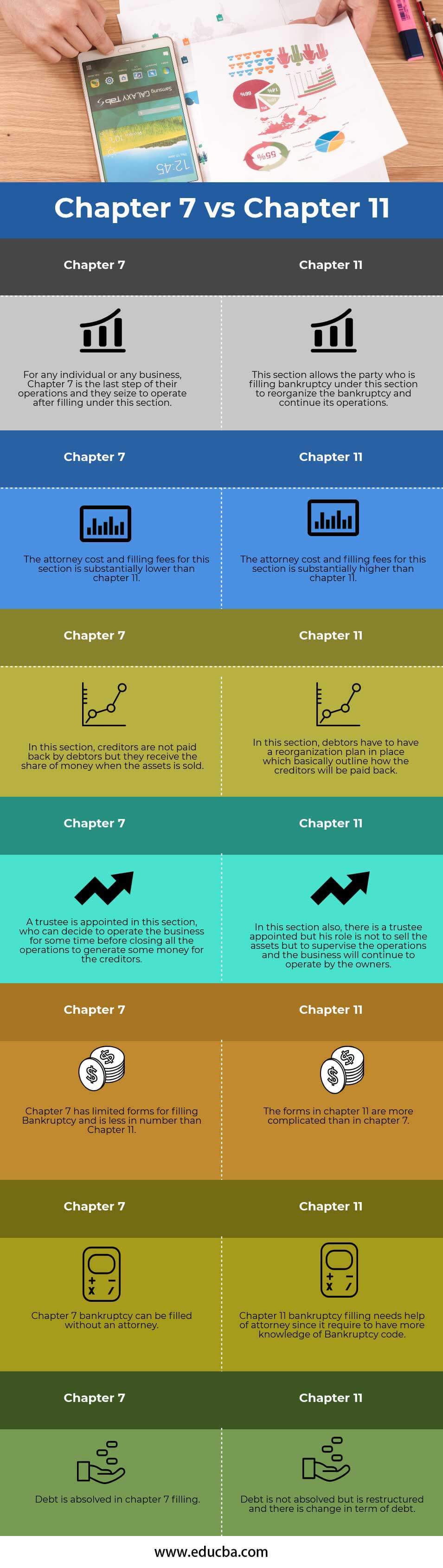

Diff between chapter 7 and 11. So if you file for Chapter 7 youll have to sell your assets to pay as many creditors as possible. Chapter 11 and Businesses. Though used mainly by large corporations it can also be beneficial to small business owners.

If you find yourself in debt again you will not be able to file for. Chapter 11 is generally the best way to alleviate your liabilities without going out of business. There are five different kinds of bankruptcy cases.

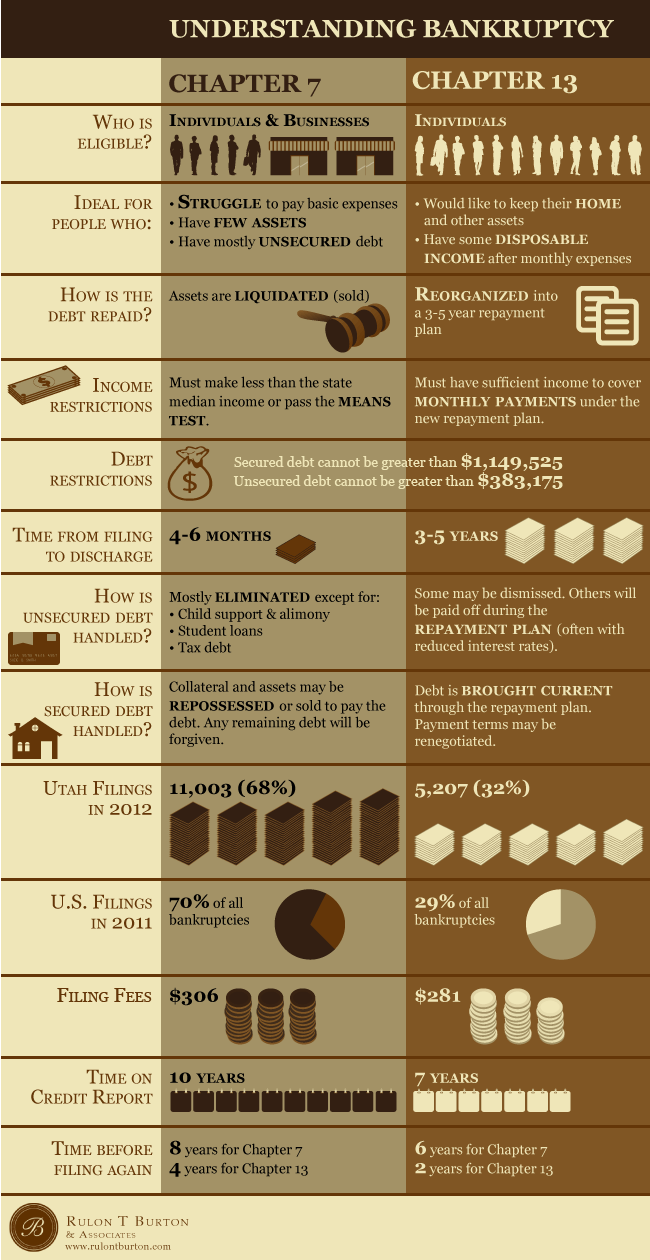

You will most likely lose property and the damaging bankruptcy information will stay on your credit report for 10 years following the filing date. Here are the basics. Instead repayments are re-organized.

Chapter 7 can help a business close by selling off its property to pay creditors. Chapter 11 Reorganization Bankruptcy Chapter 11 bankruptcy is designed to allow businesses to continue to operate while repaying necessary debts and restructuring the company for long-term success. Because Chapter 13 is more complex and time-consuming they are more expensive to execute.

Chapter 7 and 11 bankruptcy are only two of the alternatives an entity may have. The main difference between Chapter 7 bankruptcy and Chapter 11 bankruptcy is that debts are not discharged. Below we explain the differences between Chapter 11 and Chapter 7 bankruptcy for businesses.

If you are running a sole proprietorship however Chapter 13 might be a. Chapters 7 9 11 12. Chapter 7 is a liquidation bankruptcy that doesnt require a repayment plan but does require you to sell some assets to pay creditors.

In the instance that an entity is unable to pay for their debts using their present cash they have the option of filing for bankruptcy. They are named after the chapters of the bankruptcy code book that contains the rules specific to that kind of bankruptcy. A Chapter 7 bankruptcy will.

Chapter 7 is known as a liquidation option and Chapter 11 attempts to reorganize the business by stabilizing its debts and operating expenses. However the type of relief available to individuals and businesses varies significantly and it isnt always intuitive. Chapter 11 for a business is that Chapter 11 allows a business to continue operating.

Chapter 7 of bankruptcy code is responsible for controlling the process of the liquidation of the assets where absolute priority rule are mentioned that stipulates the order according to which payment of the debt will be made whereas in case of Chapter 11 of bankruptcy code individual or the business that requires some time duration for debt repayment will approach the creditors for changing the terms and. A Chapter 7 will in effect put a business out of business while a Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. There are key differences between Chapter 7 and Chapter 11 when it comes to business bankruptcy.

Chapter 7 bankruptcy can be filed without an attorney. We will discuss their differences in this article. Chapter 7 has limited forms for filing bankruptcy and is less in number than Chapter 11.

Chapter 11 is a reorganization bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors. Considered the most complicated of the three bankruptcy processes Chapter 11 should always have experienced. Chapter 7 bankruptcy is the most common form of bankruptcy.

While Chapter 7 and Chapter 13 are bankruptcies most often used by individuals Chapter 11 is generally reserved for businesses seeking reorganization of their finances. Chapter 7 can devastate the majority of your assets. Chapter 11 bankruptcy filing needs the help of an attorney.

The main difference between Chapter 7 and Chapter 11 bankruptcy is that under a Chapter 7 bankruptcy filing the debtors assets are sold off to pay the lenders creditors whereas in Chapter 11 the debtor negotiates with creditors to alter the terms of the loan without having to liquidate sell off assets. The Chapter 11 is a reorganization bankruptcy for the business. Corporations partnerships and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

The forms in chapter 11 are more complicated than in chapter 7. Chapter 13 does not eliminate debts swiftly the way that Chapter 7 does. Each class of creditors can be provided for in the bankruptcy plan proposed by the Chapter 11 debtor in possession often in the form of monthly payments distributed based on the types of debt the filer has.

Because the debt involved tends to be high creditors are extremely concerned about getting a good portion of their money back. Both Chapters 7 and 11 strike a balance between providing debt relief to filers and payment to creditors. This is because Chapter 7 typically results in the liquidation of the entire company and Chapter 13 is not available for business entities.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. The difference between Chapter 7 vs.

Do We Have Chapter 7 Or Chapter 13 Bankruptcy In Canada

Do We Have Chapter 7 Or Chapter 13 Bankruptcy In Canada

Alikhan Law Office Llc In Las Vegas Nevada 702 374 6619

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

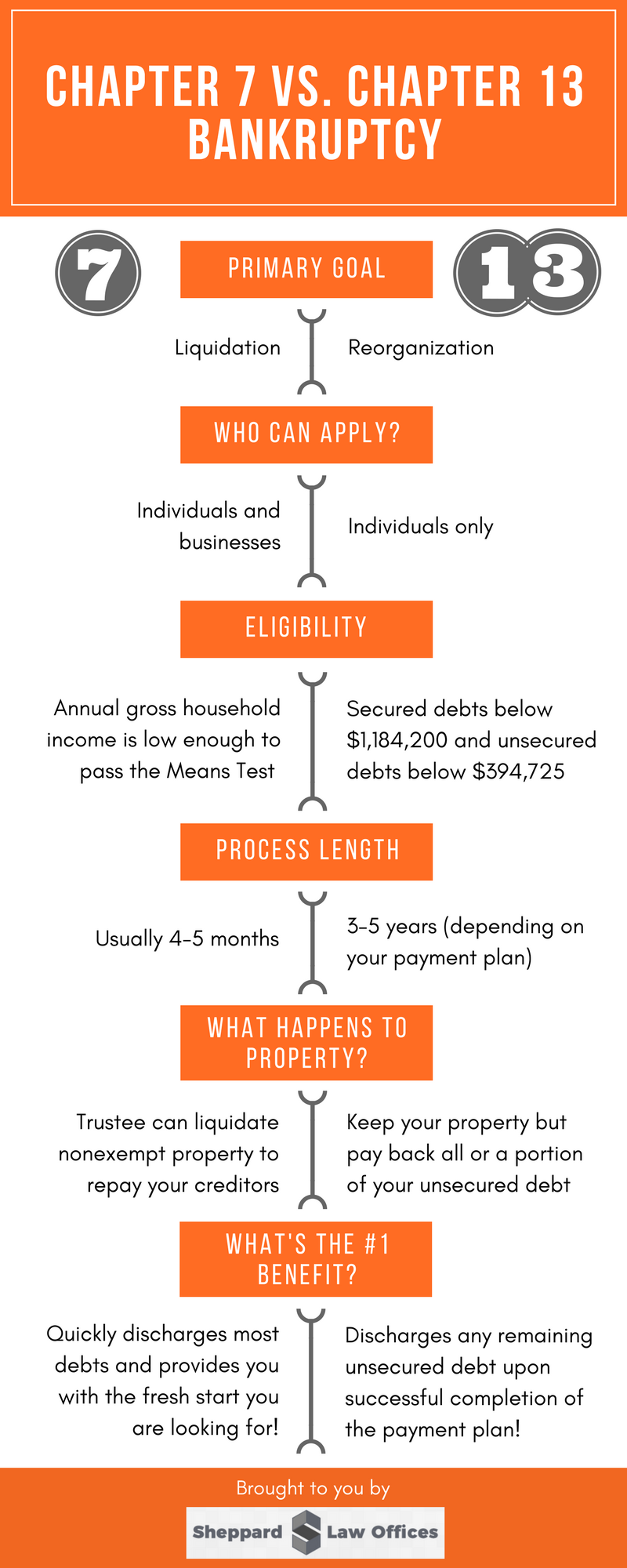

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Chapter 7 Vs Chapter 13 What Is The Difference All About Infographic

Chapter 7 Vs Chapter 13 Bankruptcy Sheppard Law Office

Chapter 7 Vs Chapter 13 Bankruptcy Sheppard Law Office

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.