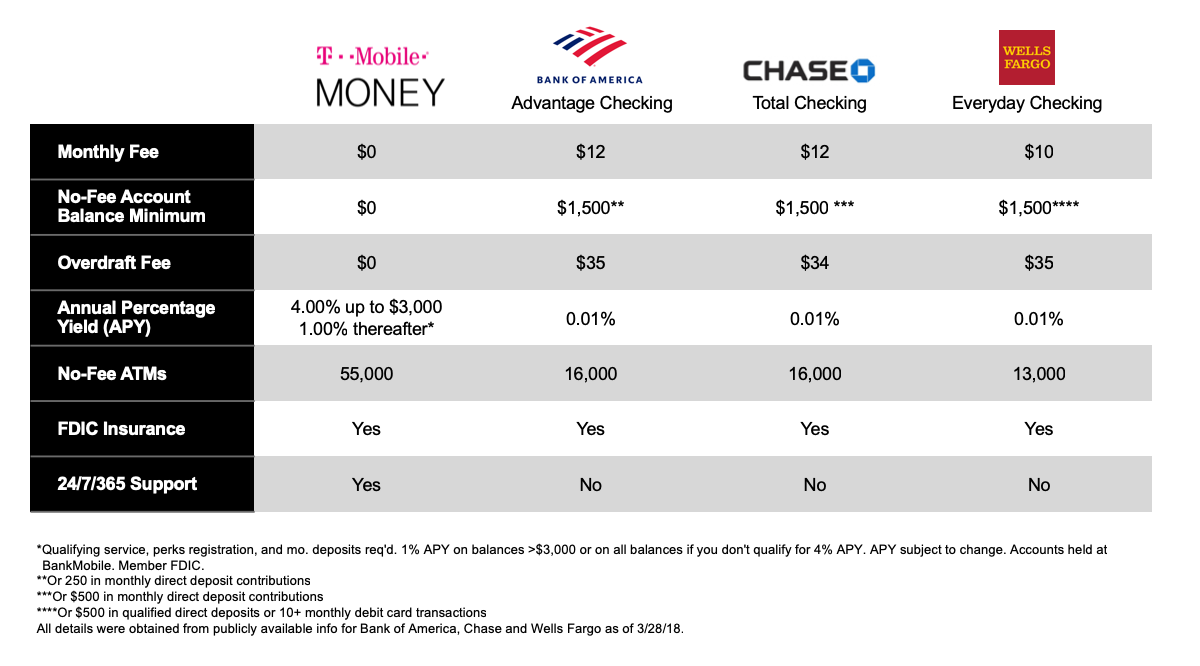

The financial institution product and APY Annual Percentage Yield data displayed on this website is gathered from various sources and may not reflect all of the offers available in your region. T-Mobile provides these banking services in conjunction with BankMobile a division of Customers Bank Member FDIC.

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

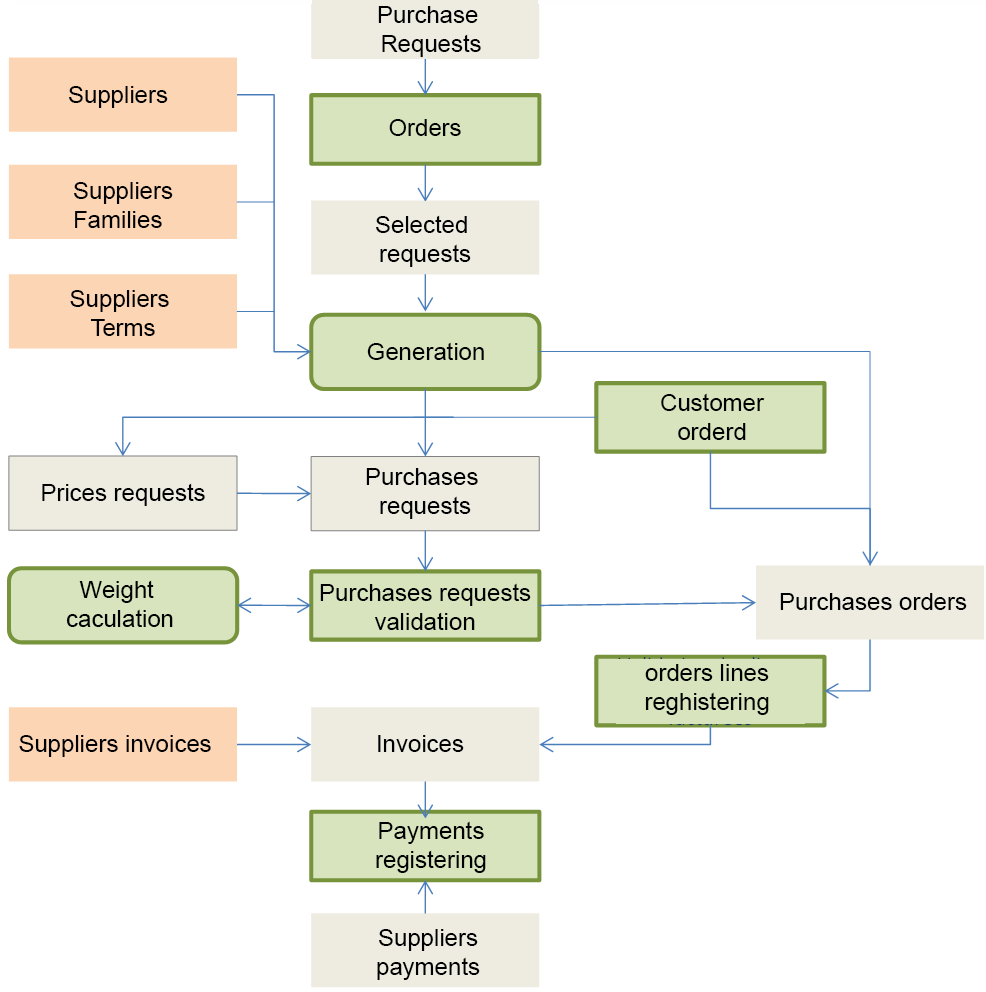

The deal with T-Mobile represents a major expansion of the BankMobiles Banking as a Service strategy.

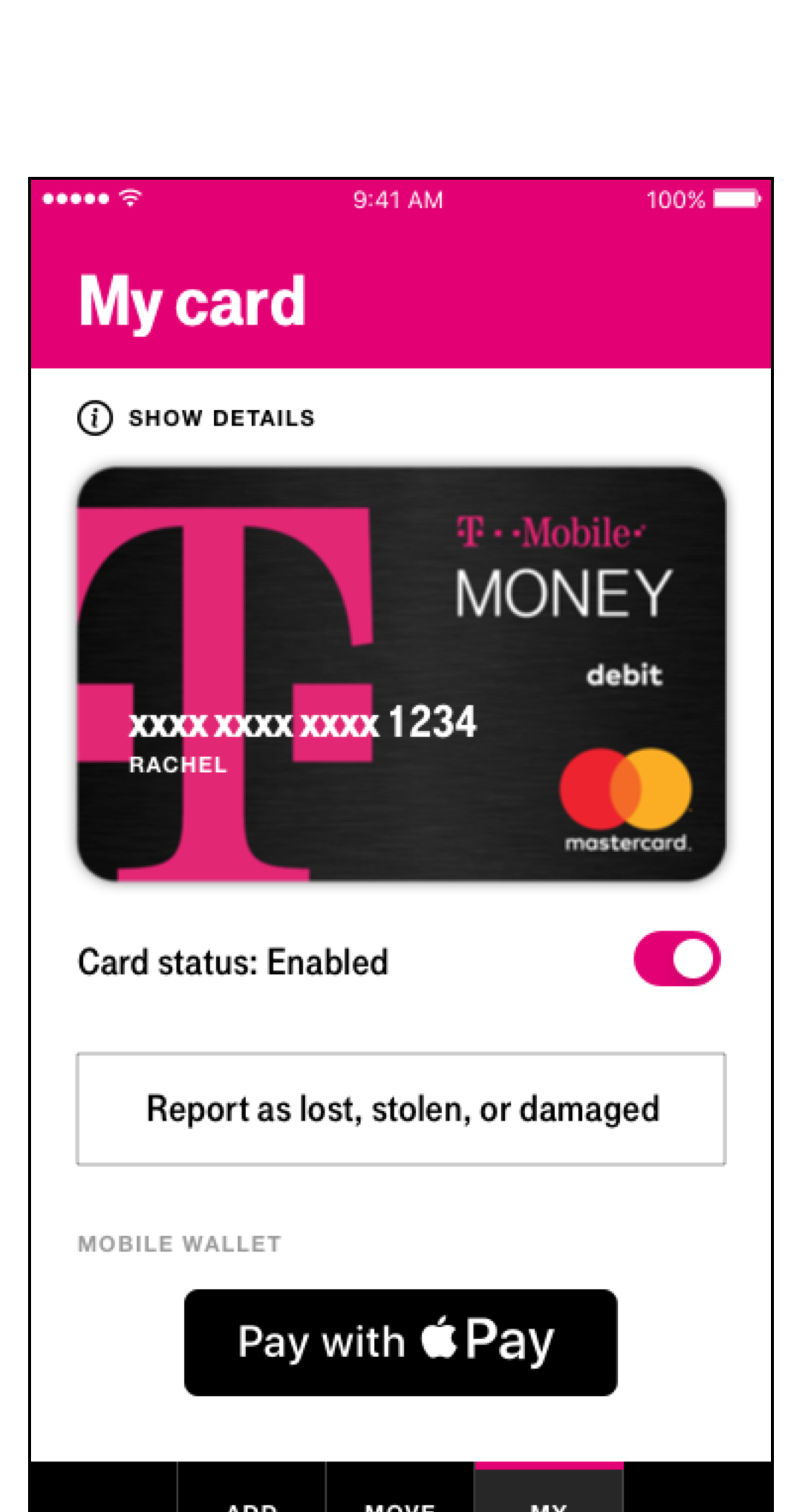

What bank is t mobile money. The app is available on iOS through the App Store or Google Pay according to the site and accounts are FDIC supported up to 250000. I transferred 3K in on Feb 1 yup -- less than 3 weeks ago. T-Mobile MONEY Specialists are available any day of the year at 866-686-9358 or MONEY from your device if youre a T-Mobile wireless customer.

We expect to see revenues from merchant transaction fees when a customer pays with their T-Mobile MONEY Mastercard debit card. That APY is high but it is only available to MONEY account holders who are also enrolled in a T-Mobile wireless phone plan. T-Mobile previously launched a service called Mobile Money in 2014 which it discontinued in 2016.

T-Mobile Money is an Internet only bank and does not have branch locations. T-Mobile MONEY deposits are FDIC-insured up to 250000. Your money goes further with T-Mobile MONEY.

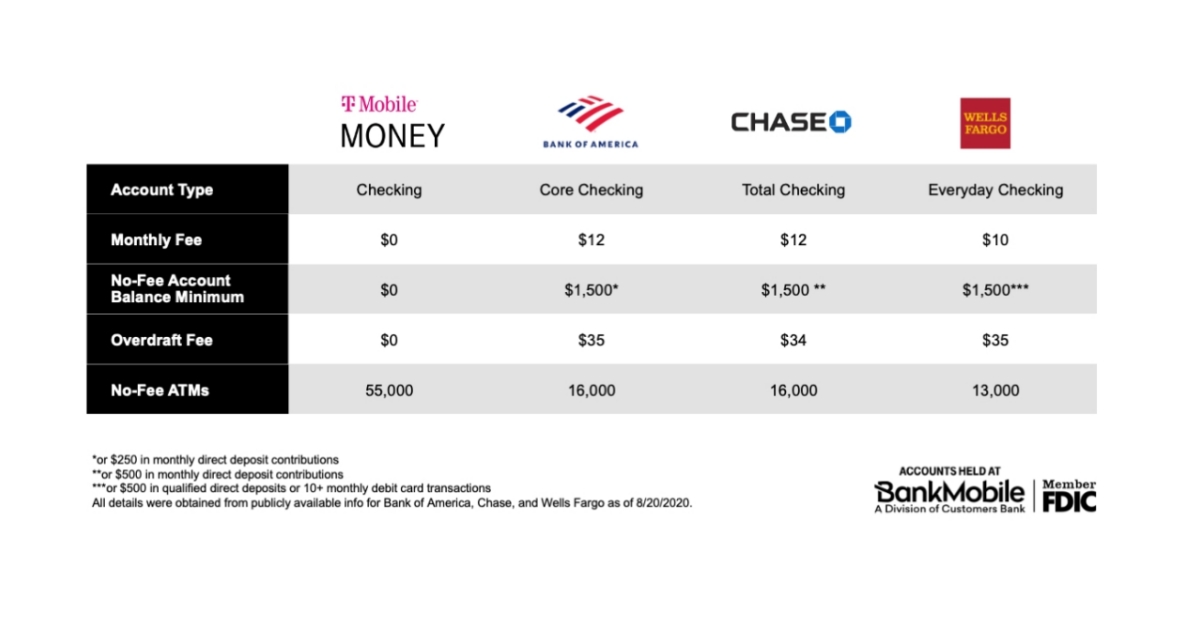

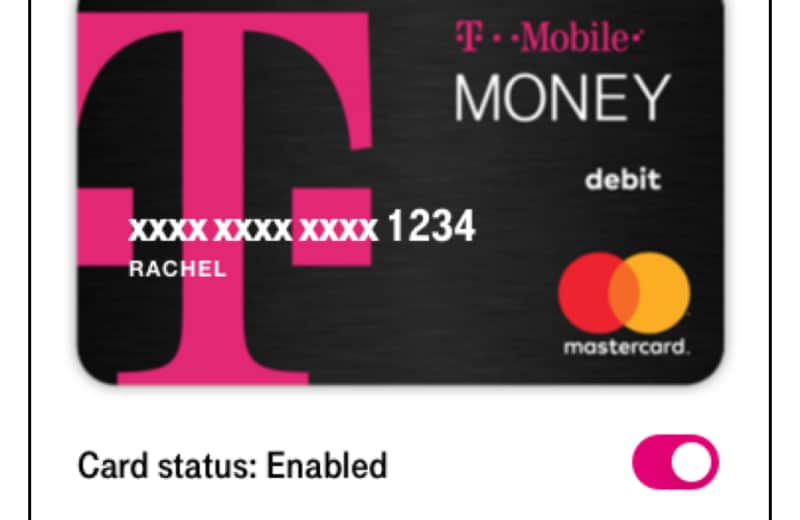

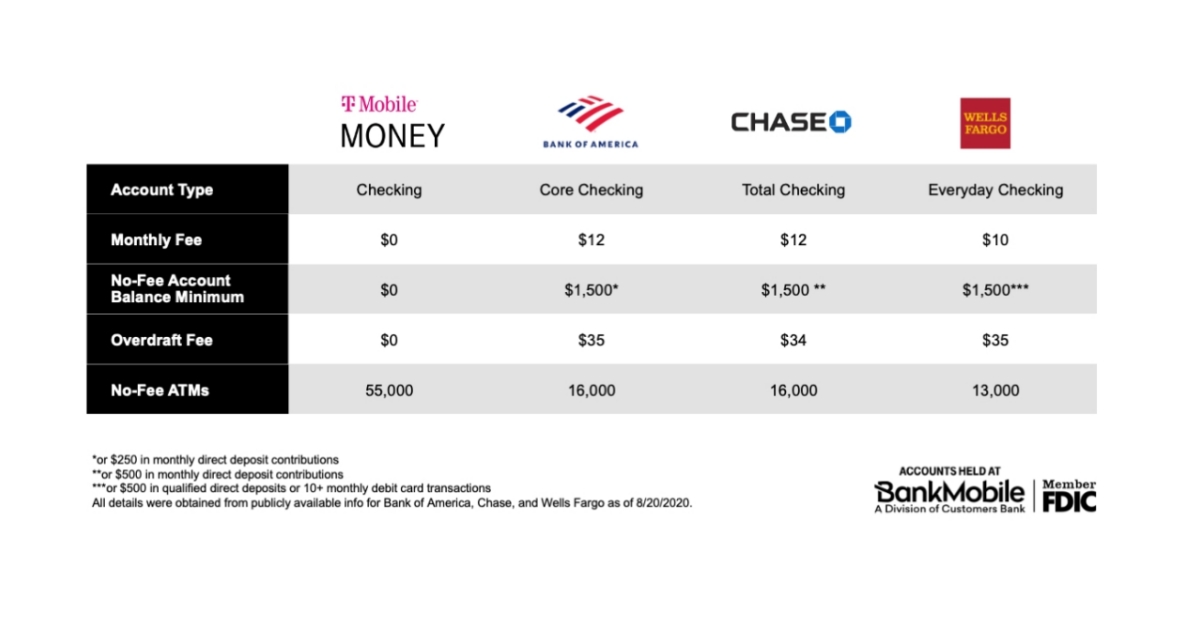

Get a high-interest checking account with no minimum balance no account fees no overdraft fees and access to over 55000 fee-free ATMs. T-Mobile MONEY is a mobile app provided by T-Mobile. The biggest plus is its 4 percent APY.

T-Mobile MONEY accounts held at BankMobile a division of Customers Bank is FDIC insured and has no monthly fees no minimum balance fees no overdraft fees no transfer fees and no late payment fees. T-Mobile Money isnt available on Finder right now. Customers can get 247 bi-lingual customer service and support with T-Mobile MONEY Specialists.

Furthermore T-Mobile Money is FDIC insured and has no monthly fees no minimum balance fees no overdraft fees no transfer fees and no late payment fees. What is T-Mobile MONEY. T-Mobile Money is owned by T-Mobile USA Inc a mobile phone service company.

While these accounts are not limited to T-Mobile customers those with T-Mobile postpaid plans may be able to enjoy additional benefits. T-Mobile Money is a hybrid savings and checking account created in partnership with BankMobile. If youre calling from outside of the United States please dial 414-751-6700.

T-Mobile MONEY Checking Account Accounts Held at BankMobile a Division of Customers Bank Member FDIC. One of the biggest wireless companies in the US. The popular telco service provider T-Mobile steps into banking with a checking account that earns its wireless customers a whopping 4 APY on their first 3000 and reverts to 1 for balances above this amount and for those who dont qualify.

In addition you can also take advantage of a range of great promotions from banks such as HSBC Bank Chase Bank Huntington Bank Discover Bank TD Bank BBVA or CIT Bank. Customers Bank is a traditional brick-and-mortar bank with 15 branches in New Jersey New York and Pennsylvania. T-Mobile MONEY offers an FDIC insured high-interest checking account with no account overdraft fees no minimum balance and over 55000 no-fee ATMs worldwide with Allpoint ATM Network.

This is all handled between T-Mobile merchants and BankMobile a division of Customers Bank the issuing bank. To be abundantly clear T-Mobile doesnt operate its own bank. Is T-Mobile Money legit.

The banking engine behind T-Mobile Money is BankMobile the mobile-first division of Pennsylvanias 98 billion Customers Bank. The terms and conditions set forth below contain important information regarding your relationship with BankMobile a Division of Customers Bank and its service partners. The catch was to make a minimum 200 deposit each month.

I set up an account with T-Mobile Money Customers Bank solely to take advantage of 4 interest on 3000. I changed payroll automatic deposit to drop 200 in each month. - Bellevue WA 98006.

More about the T-Mobile bank account Its still a legit checking account with FDIC insurance for balances up to 250000 the nifty ability to send paper checks from. T-Mobile MONEY is created in partnership with BankMobile a division of Customers Bank Member FDIC and has been available in a limited pilot since November 2018. Accounts held at BankMobile a division of Customers Bank.

Instead the company has partnered with BankMobile to offer an interest checking account that exceeds the competition. T-Mobile MONEY is an online checking account that provides a host of benefits tailored to people who seek higher interest rates and lower fees. Its headquarters is located at 12920 Se 38th St.

T Mobile Money Rocks Banking Model Using Fintech Engine

T Mobile Money Rocks Banking Model Using Fintech Engine

It Pays Literally To Be With The Un Carrier Full T Mobile Money Benefits Extend To Sprint Customers T Mobile Newsroom

It Pays Literally To Be With The Un Carrier Full T Mobile Money Benefits Extend To Sprint Customers T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

T Mobile Finally Launches Its New Banking Service T Mobile Money

T Mobile Finally Launches Its New Banking Service T Mobile Money

T Mobile Money Review Earn 4 Apy On Balances Up To 3 000 New Requirements Doctor Of Credit

T Mobile Money Review Earn 4 Apy On Balances Up To 3 000 New Requirements Doctor Of Credit

/cdn.vox-cdn.com/uploads/chorus_image/image/62553928/Screen_Shot_2018_11_29_at_11.05.37_AM.0.png) T Mobile Just Launched Its Own Checking Account Service The Verge

T Mobile Just Launched Its Own Checking Account Service The Verge

It Pays Literally To Be With The Un Carrier Full T Mobile Money Benefits Extend To Sprint Customers Business Wire

It Pays Literally To Be With The Un Carrier Full T Mobile Money Benefits Extend To Sprint Customers Business Wire

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

Bye Big Banks Hello T Mobile Money Introducing Your No Fee Interest Earning Mobile First Checking Account T Mobile Newsroom

T Mobile Money Mobile Banking Launches With Special Incentives For T Mobile Wireless Customers Geekwire

T Mobile Money Mobile Banking Launches With Special Incentives For T Mobile Wireless Customers Geekwire

Update Available Nationwide T Mobile Launches Its Own Banking Service Money So You Can Just Give Your Carrier All Of It

Update Available Nationwide T Mobile Launches Its Own Banking Service Money So You Can Just Give Your Carrier All Of It

Open A Free Online Checking Account T Mobile Money

Open A Free Online Checking Account T Mobile Money

![]() T Mobile Checking Account Review 2021 Should You Open

T Mobile Checking Account Review 2021 Should You Open

T Mobile Money Uncovered As A Banking Competitor Pocketnow

T Mobile Money Uncovered As A Banking Competitor Pocketnow

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.